drummerdimitri

Registered User

- Joined

- Apr 21, 2015

- Messages

- 442

- Reaction score

- 80

- Points

- 28

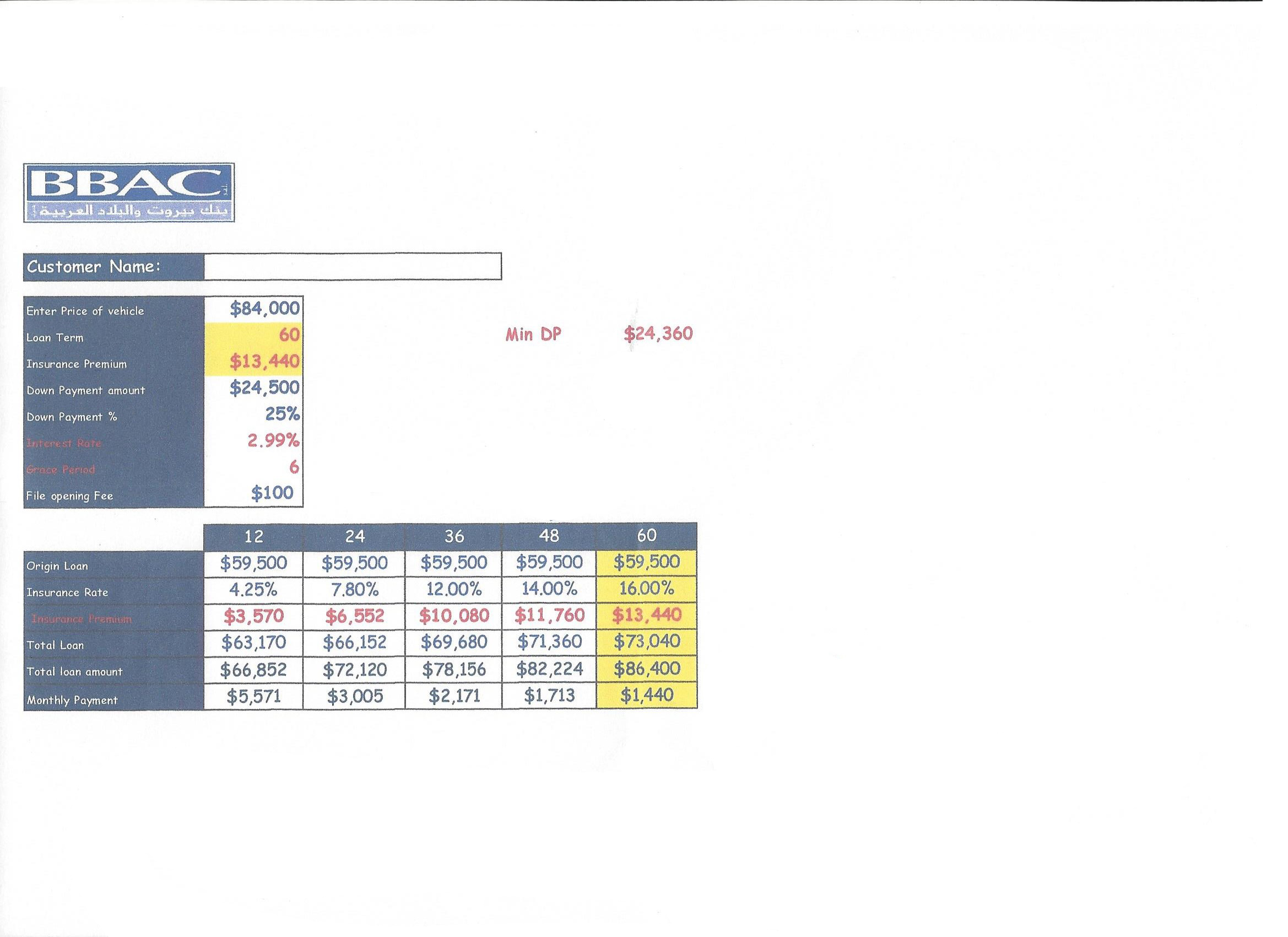

So my dealer proposed I finance the car with a bank they have a deal with.

Basically I get to chose to finance the car from a period of 1-5 years with a flat interest rate of 2.99% and a first payment of 25% of the car's present value with a grace period of 6 months.

I am getting a 4% interest rate on my savings in my bank so would I still be benefiting from a 1% gain if I finance vs 0% if I pay cash?

Is it too good to be true or am I losing money by financing the car?

What do you think I should do?

Basically I get to chose to finance the car from a period of 1-5 years with a flat interest rate of 2.99% and a first payment of 25% of the car's present value with a grace period of 6 months.

I am getting a 4% interest rate on my savings in my bank so would I still be benefiting from a 1% gain if I finance vs 0% if I pay cash?

Is it too good to be true or am I losing money by financing the car?

What do you think I should do?