taurus

Registered User

- Joined

- Oct 4, 2004

- Messages

- 54

- Reaction score

- 58

- Points

- 18

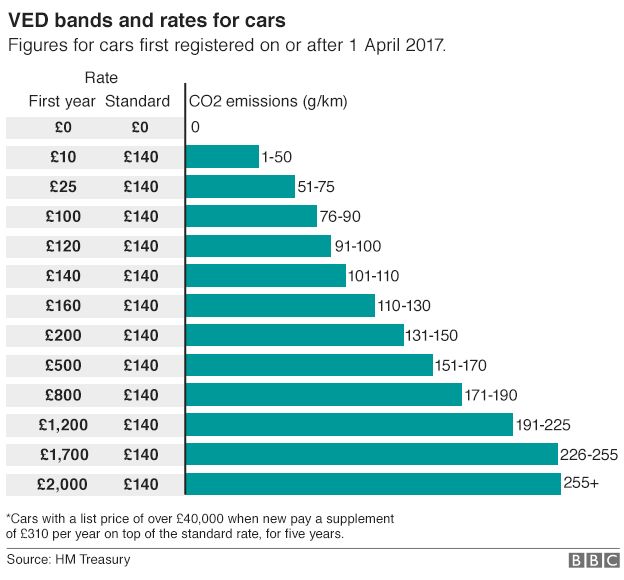

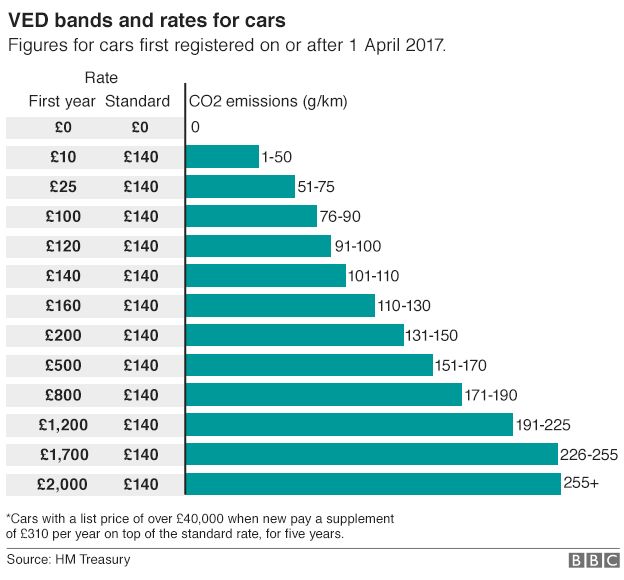

I suppose this was inevitable - car tax can't keep going down for new cars without the money rolling in to the government. It makes sense.

What it does mean, however, is even a fully-loaded S3 could be over the £40,000 mark and this means there's an extra £1,550 spread over 5 years for breaking that magic number. Not to mention a £500 first year charge. Yearly VED does drop to £140, but that's not too much of a change.

http://www.bbc.co.uk/news/business-33447106

So, I wonder if Audi will have to be clever about their optional extras? Seems a bit harsh that because you want some luxuries over and above the stock model that you get clobbered so much. I wonder how the VED is worked out - as that will mean either Audi have to shoehorn more in to the stock model, make new more affordable packs, or offer huge discounts but have an annual service of £500 in some form of loan.

Of course, this means nowt to us today, but when the 2017 cars come out and we all start to drool, we might have to drop the B&O to keep the Interior Lighting Pack!

;-)

What it does mean, however, is even a fully-loaded S3 could be over the £40,000 mark and this means there's an extra £1,550 spread over 5 years for breaking that magic number. Not to mention a £500 first year charge. Yearly VED does drop to £140, but that's not too much of a change.

http://www.bbc.co.uk/news/business-33447106

So, I wonder if Audi will have to be clever about their optional extras? Seems a bit harsh that because you want some luxuries over and above the stock model that you get clobbered so much. I wonder how the VED is worked out - as that will mean either Audi have to shoehorn more in to the stock model, make new more affordable packs, or offer huge discounts but have an annual service of £500 in some form of loan.

Of course, this means nowt to us today, but when the 2017 cars come out and we all start to drool, we might have to drop the B&O to keep the Interior Lighting Pack!

;-)

and for 5 years

and for 5 years