Hi,

i need a bit of advice..

------------------------------------------

my current insurance policy running....

golf mk4 1.4

premium: £1270 - currently paying monthly - until dec 2013

third party fire and theft

------------------------------------------

now im wanting to purchase this car:

audi a3 2.0t fsi s line quattro

value: £8000

------------------------------------------

so i have to switch my policy to comprehensive as its over 5k, but they are wanting an extra £1400 off me - ridiculous

if i list it as value £5000 and carry on TPFT they only want £200 off me. (is this ok to do until my current policy ends in 6 months? )

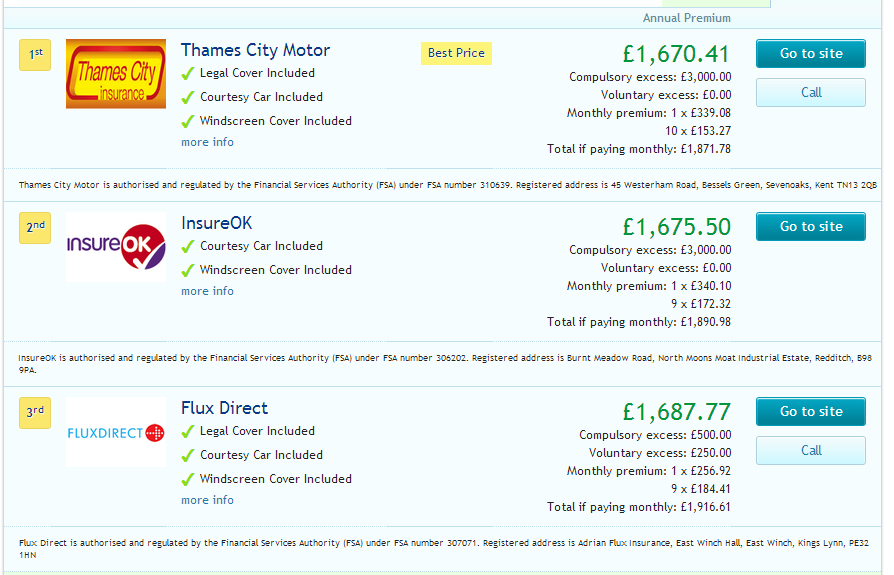

i can get the premium for audi a3 elsewhere for a total of £1200 now, but i dont want to end my current policy as im only half way through it - would have to pay it off + extra changes

so any advice here appreciated, sorry if this is confusing lol

i need a bit of advice..

------------------------------------------

my current insurance policy running....

golf mk4 1.4

premium: £1270 - currently paying monthly - until dec 2013

third party fire and theft

------------------------------------------

now im wanting to purchase this car:

audi a3 2.0t fsi s line quattro

value: £8000

------------------------------------------

so i have to switch my policy to comprehensive as its over 5k, but they are wanting an extra £1400 off me - ridiculous

if i list it as value £5000 and carry on TPFT they only want £200 off me. (is this ok to do until my current policy ends in 6 months? )

i can get the premium for audi a3 elsewhere for a total of £1200 now, but i dont want to end my current policy as im only half way through it - would have to pay it off + extra changes

so any advice here appreciated, sorry if this is confusing lol