Hi guys, I currently own the s3 sport back that's being sold soon to upgrade to the rs3, now never had a car on finance so not sure what kind of prices to expect, can anyone either post on here or pm me your deal you got ie monthly instalments deposit payed over how many months and what the bloom payment is and total cost of car + apr? Many thanks

To everyone who has an rs3 on finance?

- Thread starter kilojade

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

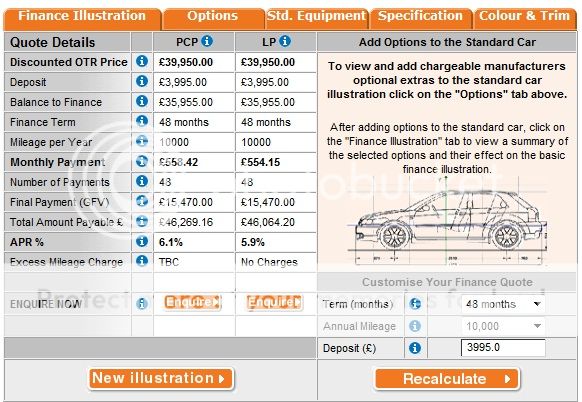

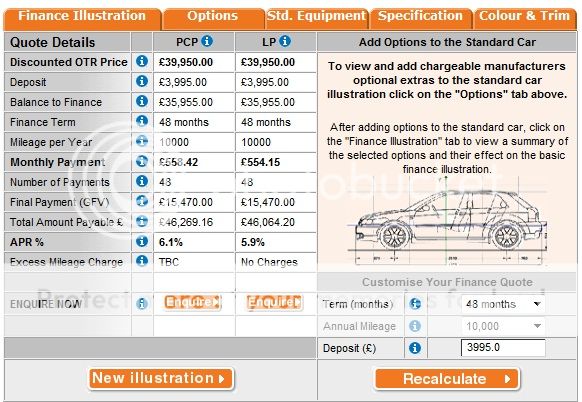

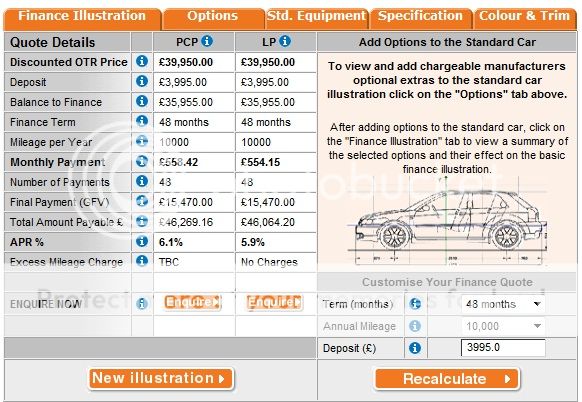

I went with the low payment option, similar to this one on the right ... but went direct to the lender to cut out the commission

AUDI RS3 SPORTBACK 2.5T FSI RS3 Quattro 5dr S Tronic PCP Quote

The monthy payments were no more than my old Golf R ... although the final balloon payment is a lot higer

AUDI RS3 SPORTBACK 2.5T FSI RS3 Quattro 5dr S Tronic PCP Quote

The monthy payments were no more than my old Golf R ... although the final balloon payment is a lot higer

MBK

Registered User

- Joined

- May 3, 2012

- Messages

- 1,161

- Reaction score

- 1,111

- Points

- 113

- Location

- Neath

- Website

- www.youtube.com

Just my view but I'd avoid PCP if you can, the low deposit and monthly payments look attractive but when you work out the interest you pay it's an expensive way to go. Depends how much you are looking to borrow but 1 or even 2 personal loans will probably work out cheaper as there are some excellent rates around at the moment for less than £15k.

As an example even if you borrowed 2 x £15K loans over 3 years at 6% you'd only pay back £4k in interest. In the same time a PCP at 7% APR (about the best you'll get from Audi imo) would cost nearer £7K - worse if they give you a higher balloon payment. If they quote you the usual starting bid 12% APR and tempt you with a minimum 10% deposit you could be looking at £10K in interest over 3 years - the interest really adds up when you defer paying back larger amounts.

It's a good market for shopping around in, there is some cheap money out there and push the dealer for a good deal too - they are far from overrun with people wanting to spend £40K plus whatever they tell you.

As an example even if you borrowed 2 x £15K loans over 3 years at 6% you'd only pay back £4k in interest. In the same time a PCP at 7% APR (about the best you'll get from Audi imo) would cost nearer £7K - worse if they give you a higher balloon payment. If they quote you the usual starting bid 12% APR and tempt you with a minimum 10% deposit you could be looking at £10K in interest over 3 years - the interest really adds up when you defer paying back larger amounts.

It's a good market for shopping around in, there is some cheap money out there and push the dealer for a good deal too - they are far from overrun with people wanting to spend £40K plus whatever they tell you.

I went with the low payment option, similar to this one on the right ... but went direct to the lender to cut out the commission

AUDI RS3 SPORTBACK 2.5T FSI RS3 Quattro 5dr S Tronic PCP Quote

The monthy payments were no more than my old Golf R ... although the final balloon payment is a lot higer

You can get a better residual value than this which will bring down your monthly payments. £15.5k is pretty low actually I'd be expecting 18-20k at least for a brand new car. Remember the more residual value the less amount you will have to pay finance on.

I prefer to go for the lowest APR and the lowest overall total amount payment first, then the lowest monthly payment second ...

if your ballon payment is high at the end, it means when you trade in, your settlement value will also be high ... leaving less for your deposit on the next car.

You pay interest on the whiole amount borrowed including the balloon payment

if your ballon payment is high at the end, it means when you trade in, your settlement value will also be high ... leaving less for your deposit on the next car.

You pay interest on the whiole amount borrowed including the balloon payment

I think if you are going to keep it or go full term I 100% agree with you. I guess thats the first question you have to ask yourself.

I won't go full term so for me it was about the cheapest monthly payments. Next car i'll add what I need to and move on.

If I was going to keep a car like this I'd pay cash...

I won't go full term so for me it was about the cheapest monthly payments. Next car i'll add what I need to and move on.

If I was going to keep a car like this I'd pay cash...

As an example even if you borrowed 2 x £15K loans over 3 years at 6% you'd only pay back £4k in interest. In the same time a PCP at 7% APR (about the best you'll get from Audi imo) would cost nearer £7K - worse if they give you a higher balloon payment. If they quote you the usual starting bid 12% APR and tempt you with a minimum 10% deposit you could be looking at £10K in interest over 3 years - the interest really adds up when you defer paying back larger amounts.

It's a good market for shopping around in, there is some cheap money out there and push the dealer for a good deal too - they are far from overrun with people wanting to spend £40K plus whatever they tell you.

I agree with what you say, but doing it that way (£30,000 as two £15,000 personal loans) the monthly payments would be around £900 over 3 years.

I agree with what you say, but doing it that way (£30,000 as two £15,000 personal loans) the monthly payments would be around £900 over 3 years.

WOW. £900 a month.. and don't forgot at the end of those 3 years you would loose £10-20k on the price of the car..

If I was going to keep a car like this I'd pay cash...

Yeah me too ... I just need that lottery win

Yeah me too ... I just need that lottery win

Don't get me wrong.. I'd never do it.. Prefer the finance companies taking the risk..

I hope everyone is signing up to www.RS3OC.com..

Hi, just following on what's been said, so what would be the most important factor if I were to go down the PCP route? Is it the lowest APR, lowest monthly, deposit amount? Also is it better to have a high or low balloon payment at the end?

Sorry for the questions but I get so confused with all these numbers! I understand PCP in principle but I don't know if what a dealer is offering is a good deal (hypothetical). I can imagine them asking me "what can you afford to pay per month", which is not the point!

Agreed, overall cost is higher than other forms of finance but if the car is going to be traded after 3 years or so, it's not so bad is it?

Thanks for any input.

Sorry for the questions but I get so confused with all these numbers! I understand PCP in principle but I don't know if what a dealer is offering is a good deal (hypothetical). I can imagine them asking me "what can you afford to pay per month", which is not the point!

Agreed, overall cost is higher than other forms of finance but if the car is going to be traded after 3 years or so, it's not so bad is it?

Thanks for any input.

TBH a combination of all factors. Reality is though that finance companies will not give high FCV's anyway, typically on new RS3's they are £14-18k if your are lucky so the rest is on deposit, APR and monthly payment. The lower the APR then the lower the payment. The more deposit you put in the lower the payments. Lowest APR's at present on say 48 months are 6.9% up to 11.9% having just researched this myself.

My view is that all cars are depreciating assets; for the price of a tank of fuel every month in interest I'd rather someone else takes the capital risk and I use my own money elsewhere where it gets a return, invariably in the long term more than the interest on the PCP is.

My view is that all cars are depreciating assets; for the price of a tank of fuel every month in interest I'd rather someone else takes the capital risk and I use my own money elsewhere where it gets a return, invariably in the long term more than the interest on the PCP is.

MBK

Registered User

- Joined

- May 3, 2012

- Messages

- 1,161

- Reaction score

- 1,111

- Points

- 113

- Location

- Neath

- Website

- www.youtube.com

A good deal is such a subjective thing, ultimately it has to be one you are happy with. I think PCP's are the work of the devil because they generally lure people in to buying a more expensive car than they can really afford and keep them on the PCP payment treadmill for years. If you are wise enough to avoid that trap they can work and I can see the points made by several people about the finance company taking the risk and being able to use your capital elsewhere.

I'd say a good deal has a few features:

- low APR at the moment that means 7% or less,

- decent 10%+ discount (especially if you are buying with their finance) and other goodies like free servicing or extended warranty

- and/or good part exchange price (there are plenty of ways to check the px price these days)

- Monthly payments you can easily afford and allow you to pursue your other interests in life, as much as I like cars they are just a means to that end for me.

I'd say a good deal has a few features:

- low APR at the moment that means 7% or less,

- decent 10%+ discount (especially if you are buying with their finance) and other goodies like free servicing or extended warranty

- and/or good part exchange price (there are plenty of ways to check the px price these days)

- Monthly payments you can easily afford and allow you to pursue your other interests in life, as much as I like cars they are just a means to that end for me.

If you are looking at a 3 year PCP with hefty deposit sub 7% is achievable; but if a small (<10%) deposit then expect more like 9-11% as standard which with haggling you may get down to 7%

Discounts are there to be had, free servvicing is not aalways possible as it is a separate product under Audi options now and requires a new DD set up to be put through, backdating warranty if on a unreg actual car is also a little tricky but can be done. The winner really is getting the finance as best you can if you are going that route and minimising the interest you pay which more then makes up for what discounts / toys / extras you could have had instead.

Discounts are there to be had, free servvicing is not aalways possible as it is a separate product under Audi options now and requires a new DD set up to be put through, backdating warranty if on a unreg actual car is also a little tricky but can be done. The winner really is getting the finance as best you can if you are going that route and minimising the interest you pay which more then makes up for what discounts / toys / extras you could have had instead.

For me the two key things with PCP are :-

1. Low APR (must be less then 7% for me)

2. Reasonably low monthly payments which are around, or just above, my car allowance (from my job)

The balloon payment works both ways ... a high one will keep your monthly payments lower BUT when you come to trade in, and settle the finance, the part exchange price you get may only just cover the finance settlement. Whereas if your balloon payment is low, you pay more each month but should get more back at the end.

As long as you can afford to pay the monthly payments and get a low APR %, PCP is OK IMHO and good for cars with higher residual values (such as Mercs and Audi's etc)

1. Low APR (must be less then 7% for me)

2. Reasonably low monthly payments which are around, or just above, my car allowance (from my job)

The balloon payment works both ways ... a high one will keep your monthly payments lower BUT when you come to trade in, and settle the finance, the part exchange price you get may only just cover the finance settlement. Whereas if your balloon payment is low, you pay more each month but should get more back at the end.

As long as you can afford to pay the monthly payments and get a low APR %, PCP is OK IMHO and good for cars with higher residual values (such as Mercs and Audi's etc)

Thanks everyone with the awesome advice, much appreciated. I have never purchased a car on finance before hence the lack of knowledge. I remember back in the day hire purchase was the preferred form of buying a car but as MBK has mentioned, PCP allows for a more expensive car to be obtainable. My choices are Golf R or the S3 but as I'm in the RS3 forum, I guess I cannot discount that beast of a car either (but will have to check the figures carefully)...

Thanks again for all your help.

Thanks again for all your help.

My choices are Golf R or the S3 but as I'm in the RS3 forum, I guess I cannot discount that beast of a car either (but will have to check the figures carefully)...

I have just come from a Golf R ... fantastic to drive, in fact better handling than the RS3 ...but it can't match the RS3's engine or 7-speed S-tronic box.

If you go to the link above that I posted and play around with cars and specs, the RS3 monthly payments are nearly the same as the Golf R's (depending on the spec you choose). That is the reason I opted for an RS3 rather than another Golf R (I think the same is true with Knobby too ?)

The reason being that the RS3's residual value (which dictates the final balloon payment) is much much higher than the R's, meaning lower monthly payments.

AUDI RS3 SPORTBACK 2.5T FSI RS3 Quattro 5dr S Tronic PCP Quote

Hi guys, I currently own the s3 sport back that's being sold soon to upgrade to the rs3, now never had a car on finance so not sure what kind of prices to expect, can anyone either post on here or pm me your deal you got ie monthly instalments deposit payed over how many months and what the bloom payment is and total cost of car + apr? Many thanks

Paid CASH for mine: oh the HAPPY days of the long-employed OAP!

Done 240-miles (in the RS3) around the Cotswolds today (Staffordshire to Westonbirt); what an enjoyable piece of machinery the RS3 is, even on a nice day...

Last edited:

Dave Hedgehog

Registered User

I have just come from a Golf R ... fantastic to drive, in fact better handling than the RS3 ...but it can't match the RS3's engine or 7-speed S-tronic box.

If you go to the link above that I posted and play around with cars and specs, the RS3 monthly payments are nearly the same as the Golf R's (depending on the spec you choose). That is the reason I opted for an RS3 rather than another Golf R (I think the same is true with Knobby too ?)

The reason being that the RS3's residual value (which dictates the final balloon payment) is much much higher than the R's, meaning lower monthly payments.

AUDI RS3 SPORTBACK 2.5T FSI RS3 Quattro 5dr S Tronic PCP Quote

When my first RS3 blew up I had the option to get a refund and I drove the Golf R as an its obvious replacement, I don't think the mag suspension increases grip (that's ultimatly a function of the tyres) what i found it does do is it allows you to be lazy and lob the car about and let the computer sort it out, corner smoothly and there was not much in it imo

overall i found the car very dull and lacking in character and ****** expensive (my spec was 42k) for a golf! i find all the VAG blown 4 engines pretty soulless whether its in the R Golf, S3 or A5 black edition. oddly the R golf has tonnes of low down grunt which the S3 lacks. The TV rear parking system is brilliant!

Audi lent me a 2011 DSG S3 as a loan car whilst i waited for my new RS3, I put 5k miles on it, It surprised me in that it drives pretty much like my old R32, i.e. it will go sideways everywhere on a trailing throttle (Golf R didnt like this much, i think the computer trys to adjust the suspension to stop it getting the *** out, probably needs a slightly different driving style and practice) the engine has a big bang up the top end but lacks low and mid range grunt, growls up top as well, but the engine feels souless to me

With no RS3 given the choice between the S3 and R Golf I would buy a late R32 Golf, sure its not as fast or as clever but the engine has character in spades and makes a fantastic noise

Finance, i,ve just been quoted on a brand new rs3 ,42k ,no deposit,798 per month for 48 months on pcp with 16600 at the end of the term ,this is with audi,through ,mann island finance ltd . First one got decined with vw finance . Not sure on the apr ,but will find this out .

So any other good finance company out there ,that you are using on the rs3?

So any other good finance company out there ,that you are using on the rs3?

So any other good finance company out there ,that you are using on the rs3?

Clydesdale Bank Asset Finance were best for me, but they will only lend around £35,000 max on an RS3 :-

Cash Price of Goods net of any discount 39,990.00

Deposit 5,156.00

Balance to Finance 34,834.00

Amount of Credit 34,834.00

Total Charge for Credit 5,795.32

Documentation Fee (included in the first instalment)150.00

Completion Fee (included in the final instalment)150.00

ANNUALPERCENTAGE RATE 5.8%

| Gross Repayments £ | Number of Repayments | Frequency | Start Date |

678.09 | 1 | Monthly | 29/09/2012 |

528.09 | 46 | Monthly | 29/10/2012 |

15,659.09 | 1 | Monthly | 29/08/2016 |

- Joined

- Mar 28, 2010

- Messages

- 10,073

- Reaction score

- 2,697

- Points

- 113

- Location

- Liverpool/Southport. N west

ive never understood car finance because i've never had it and dont know the ins n outs of friends on it. but, do yu guys reeaalllly pay out 15k final payment on a car after 4 years?? really? i cant get my head around that

ive never understood car finance because i've never had it and dont know the ins n outs of friends on it. but, do yu guys reeaalllly pay out 15k final payment on a car after 4 years?? really? i cant get my head around that

or they hand it back karl! so in theory just hiring it!

coatesy

poking badgers with spoons

- Joined

- Oct 12, 2010

- Messages

- 1,918

- Reaction score

- 280

- Points

- 83

- Location

- Middlesbrough, United Kingdom

I can't even grasp the fact that some people pay out 600 quid a month for the finance... Do you wipe your behinds with 20 pound notes. That's serious money.

Congratulations whatever your life choices were you made the right ones, been able to afford that plus petrol then insurance then mortgage plus living.

That's almost my full months wage lol

Yes I'm also jealous.

Congratulations whatever your life choices were you made the right ones, been able to afford that plus petrol then insurance then mortgage plus living.

That's almost my full months wage lol

Yes I'm also jealous.

- Joined

- Mar 28, 2010

- Messages

- 10,073

- Reaction score

- 2,697

- Points

- 113

- Location

- Liverpool/Southport. N west

Dave Hedgehog

Registered User

ive never understood car finance because i've never had it and dont know the ins n outs of friends on it. but, do yu guys reeaalllly pay out 15k final payment on a car after 4 years?? really? i cant get my head around that

If they have got the figures correct with a PCP when you payment period is up the car should be worth more than the settlement figure, the idea being you can use this extra 2-3k as the deposit on your next PCP plan

By only paying interest on the final balloon payment it drastically reduces the monthly charge, the vast majority of people will either just walk away or use the extra as a deposit when the PCP is finished, but if you wish to keep the car you can finance the final payment rather than just handing over the lump sum, the finance company normally automatically qoutes you various finance packages at the end of the term

When my MKV R32s PCP finished a dealer offered me 4k more than the final balloon payment so it made sense to buy it (especially as i liked the car), when i finished paying that off and owned the car out right it gave me a decent deposit on the RS3

Last edited:

I'm also going to jump on the jealous bandwagon.

I was changing some settings via VCDS for a member with a new A5 the other day - what a car, it was plain lovely inside.

I can kind of see where you guys come from with finance though - with the reliability (in 99% of cases), warranties if anything goes wrong, new car.etc

I have always thought that finance would be a bad idea for me, I couldn't commit to anything like that!

But the more I think about it.... I spend around £300 on mods per month, I pay out £250 per month on the small loan I took out to fund the remaining cost of the car I purchased (loan ends in a year) - so that's £550 per month I typically pay per month for a 2002 A4 Avant - before the added £170 insurance!

I was changing some settings via VCDS for a member with a new A5 the other day - what a car, it was plain lovely inside.

I can kind of see where you guys come from with finance though - with the reliability (in 99% of cases), warranties if anything goes wrong, new car.etc

I have always thought that finance would be a bad idea for me, I couldn't commit to anything like that!

But the more I think about it.... I spend around £300 on mods per month, I pay out £250 per month on the small loan I took out to fund the remaining cost of the car I purchased (loan ends in a year) - so that's £550 per month I typically pay per month for a 2002 A4 Avant - before the added £170 insurance!

I'm totally on the other hand with this one, I would rather buy the car outright (if you can) rather than pay interest on a massively depreciating asset. I know not eveyone is fortunate to be in that position, but if you can I think it is by dar the best option.

- Joined

- Mar 28, 2010

- Messages

- 10,073

- Reaction score

- 2,697

- Points

- 113

- Location

- Liverpool/Southport. N west

im with you on that.I'm totally on the other hand with this one, I would rather buy the car outright (if you can) rather than pay interest on a massively depreciating asset. I know not eveyone is fortunate to be in that position, but if you can I think it is by dar the best option.

whats the point in payig all that money per month and the car isnt even yours, then they say right 15k and the car is yours, by which time the car will be worth about 30k, which you've already payed in installments.

yeh, you could sell the car, and end up with 15k, but after spending 30k of your own dosh to only get a 50% return IF you choose to buy it. no thanks.

even if you trade in for a newer car, you've only say 15k to go toward that, then start the process all over again.

granted if you did it a few times the balloon payment is gradually reduced, but, well, its a long process to actually OWN the car.

although, in some respects, it does seem a viable option for people who change cars every so often. hmmmmm, tis a weird one.

i need a hell of alot of convincing to do it myself.

p.s. i realise my figures are just random, but you get the point

im with you on that.

whats the point in payig all that money per month and the car isnt even yours, then they say right 15k and the car is yours, by which time the car will be worth about 30k, which you've already payed in installments.

yeh, you could sell the car, and end up with 15k, but after spending 30k of your own dosh to only get a 50% return IF you choose to buy it. no thanks.

even if you trade in for a newer car, you've only say 15k to go toward that, then start the process all over again.

granted if you did it a few times the balloon payment is gradually reduced, but, well, its a long process to actually OWN the car.

although, in some respects, it does seem a viable option for people who change cars every so often. hmmmmm, tis a weird one.

i need a hell of alot of convincing to do it myself.

p.s. i realise my figures are just random, but you get the point

People will always have differing opinions on this and no amount of arguing a case will change that. For me it makes sense and it will do for many others.

If I really wanted to I could have bought the car outright.... however... I would prefer my money in my bank and having the finance company holding the risk suits me. The whole ownership thing is a moot point, I have the V5C in my name so technically I own the car, not that it makes a difference as one day I will sell it, just like I would if I bought it outright. I can do a lot more with 40K in terms of gains over 5 years versus the interest I am paying on the car

How many people own their own homes?? Not many

Paid CASH for mine: oh the HAPPY days of the long-employed OAP!

Done 240-miles (in the RS3) around the Cotswolds today (Staffordshire to Westonbirt); what an enjoyable piece of machinery the RS3 is, even on a nice day...

Just to explain: I did swap this (mine for 37-years):

Plus this (mine for 7-years):

For this; without regret!:

- Joined

- Mar 28, 2010

- Messages

- 10,073

- Reaction score

- 2,697

- Points

- 113

- Location

- Liverpool/Southport. N west

i didnt mean any disrespect to any of you fellas who do this, im just getting my head around it. Im only young so have no experience of it.People will always have differing opinions on this and no amount of arguing a case will change that. For me it makes sense and it will do for many others.

If I really wanted to I could have bought the car outright.... however... I would prefer my money in my bank and having the finance company holding the risk suits me. The whole ownership thing is a moot point, I have the V5C in my name so technically I own the car, not that it makes a difference as one day I will sell it, just like I would if I bought it outright. I can do a lot more with 40K in terms of gains over 5 years versus the interest I am paying on the car

How many people own their own homes?? Not many

as you say, it suits you and many others, and i can kinda see why.

its just when you think about it basically it doesnt sound very good.

i didnt mean any disrespect to any of you fellas who do this, im just getting my head around it. Im only young so have no experience of it.

as you say, it suits you and many others, and i can kinda see why.

its just when you think about it basically it doesnt sound very good.

Sorry mate I'm not trying to make out that you meant disrespect

You can go very wrong with pcp but if done right it can work out well

- Joined

- Mar 28, 2010

- Messages

- 10,073

- Reaction score

- 2,697

- Points

- 113

- Location

- Liverpool/Southport. N west

anyway

where do i sign lol i REAAALLLY want one

They're pretty f***in awesome, sign whatever you like lol!

as you say, it suits you and many others, and i can kinda see why.

its just when you think about it basically it doesnt sound very good.

If you don't finance the car (by whatever means - loan, PCP, lease etc) then you have to stump up £40,000 or more of your hard earned readies for the pleasure of ownership. Either way you will have bought a depreciating asset.

Many choose to finance their car with set monthly payments and keep their £40,000 invested in other appreciating assests.

The thing to watch is that you don't get stung with high interest rates.

With PCP you are the registered keeper of the vehicle and you can choose insurance companies etc., so in effect you are the owner and in control of the car. You can sell it when you want and settle the finance at any time. Most people trade their car in before the finance ends as Dave said, so you don't ever need to pay the final £15,000 - it usually works out that the dealer offers you £18000 part-ex for your RS3 (or whatever) , so you end up £3000 cash in your pocket after they've settled the £15,000 finance.

Dave Hedgehog

Registered User

If you don't finance the car (by whatever means - loan, PCP, lease etc) then you have to stump up £40,000 or more of your hard earned readies for the pleasure of ownership. Either way you will have bought a depreciating asset.

Many choose to finance their car with set monthly payments and keep their £40,000 invested in other appreciating assests.

The thing to watch is that you don't get stung with high interest rates.

With PCP you are the registered keeper of the vehicle and you can choose insurance companies etc., so in effect you are the owner and in control of the car. You can sell it when you want and settle the finance at any time. Most people trade their car in before the finance ends as Dave said, so you don't ever need to pay the final £15,000 - it usually works out that the dealer offers you £18000 part-ex for your RS3 (or whatever) , so you end up £3000 cash in your pocket after they've settled the £15,000 finance.

You pay the depreciation one way or the other, the real beauty of PCP is that it gets you in the car for very little down and as small a monthly as possible, but you also have next to nothing at the end of the term to show for it, PCP is the main reason dealers have been able to ramp up the price of UK cars so much over the last 5 years.

However I am not hung up on depreciation, my annual train ticket would be £5,300 a year (more monthly) so providing a car looses roughly 5k a year over 4-5 years I am happy. Rather loose it in deprecaition than for a poxy train ticket ...