My sister recently did a voluntary termination of a PCP on a VW as the car was worth less than what she owed on it (not at the end of the term either) she handed it back with no problems, it even had a few scratches and a ding in the door. The guy that collected it turned up at her house in his own car!!! He said that the car was in the expected condition for its age. Now this is a strange one! she followed the guy down to where he took it, to then give him a lift back as it was about an hours walk (his boss had said it was close enough for him to walk back to collect his own car), he took it to 'we buy any car' which is behind the VW dealership.I went to the dealer today to sign the PCP agreement and got a nasty surprise. I personally value the ability to hand the car back at the end of the term and walk away if the car is worth less than the GFV. I know it's only one of many options but if the bottom falls out of the A3/S3/RS3 market in 4 years time then it could be a very handy option to have.

The nasty surprise was in the small print. If at the end of the term you have either exceeded the agreed mileage or Audi "consider it not to be in good repair and condition, commensurate with its age and mileage" then Audi have two choices (i) accept the return of the car with a payment for excess mileage plus a payment to cover the condition of the car (which is fine, as I expected) or (ii) not accept a return of the car at all which would force you to settle the outstanding finance amount by selling the car yourself and losing out on the difference.

So if you have done just 1 mile in excess, or the car has one scratch or dent then Audi can just say tough, we are not giving you the benefit of the GFV and put the loss on the customer. If the bottom has fallen out of the market (major recession, specific problem with the A3 range etc etc) and they were faced with lots of cars being returned it wouldn't take much for them to say let's avoid the losses of taking these cars back. Especially as Audi will likely have securitised the contracts and they would actually be owned by a Luxembourg finance company who would be the ones making the decisions and wouldn't give a damn about the customer.

I pointed this out to the business manager and he had no idea about this and said that no one in the last six years that he had worked for VAG Finance had even read the clause in the agreement let alone queried it. I am awaiting his reply tomorrow with interest.

S3 DEPRECIATION

- Thread starter Jassyo06

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Paulmichelle

Paul

- Joined

- Mar 3, 2016

- Messages

- 32

- Reaction score

- 22

- Points

- 8

- Joined

- Mar 15, 2012

- Messages

- 7,238

- Reaction score

- 14,250

- Points

- 113

I would have charged mileage and at least 1/2 hour of you time...lolMy sister recently did a voluntary termination of a PCP on a VW as the car was worth less than what she owed on it (not at the end of the term either) she handed it back with no problems, it even had a few scratches and a ding in the door. The guy that collected it turned up at her house in his own car!!! He said that the car was in the expected condition for its age. Now this is a strange one! she followed the guy down to where he took it, to then give him a lift back as it was about an hours walk (his boss had said it was close enough for him to walk back to collect his own car), he took it to 'we buy any car' which is behind the VW dealership.

It was my sister! a kick in the nuts to VW though, she brought him back in her new Ford which replaced the VW lol.I would have charged mileage and at least 1/2 hour of you time...lol

- Joined

- Mar 15, 2012

- Messages

- 7,238

- Reaction score

- 14,250

- Points

- 113

Ha ha..That's what I call 'karma'....It was my sister! a kick in the nuts to VW though, she brought him back in her new Ford which replaced the VW lol.

I need to dig out my last VWFS statement for my car, but I am sure that your loan account with them works with interest calculated daily instead of front loaded (interest added to the principal with repayments only paying off the interest initially).

With PCP, for the first year or so the interest charged to your account is higher as it's calculated on a bigger debit balance. As more and more payments are made and the loan balance reduces, the interest charged per month reduces. At that point your monthly payment to the account starts clearing the balance quicker.

Hence why changing 1/3 of the way through a finance agreement can be expensive as your monthly repayments are covering a larger portion of interest charged. Changing 2/3 way through can be a bit easier as the outstanding balance is clearing just that bit quicker from your monthly payments.

With PCP, for the first year or so the interest charged to your account is higher as it's calculated on a bigger debit balance. As more and more payments are made and the loan balance reduces, the interest charged per month reduces. At that point your monthly payment to the account starts clearing the balance quicker.

Hence why changing 1/3 of the way through a finance agreement can be expensive as your monthly repayments are covering a larger portion of interest charged. Changing 2/3 way through can be a bit easier as the outstanding balance is clearing just that bit quicker from your monthly payments.

Last edited:

I need to dig out my last VWFS statement for my car, but I am sure that your loan account with them works with interest calculated daily instead of front loaded (interest added to the principal with repayments only paying off the interest iniitally).

With PCP, for the first year or so the interest charged to your account is higher as it's calculated on a bigger debit balance. As more and more payments are made and the loan balance reduces, the interest charged per month reduces. At that point your monthly payment to the account starts clearing the balance quicker.

Hence why changing 1/3 of the way through a finance agreement can be expensive as your monthly repayments is covering a large portion of interest. Changing 2/3 way through can be a bit easier as the outstanding balance is clearing just that bit quicker from your monthly payments.

Yip,when l was in looking at swapping for a RS3 last month,Audi sent me out a yearly statement for the car ...virtually 50% of each payment was taken off as interest

Have a look at the opening balance of the VWFS statement, compared with the balance to finance on the invoice

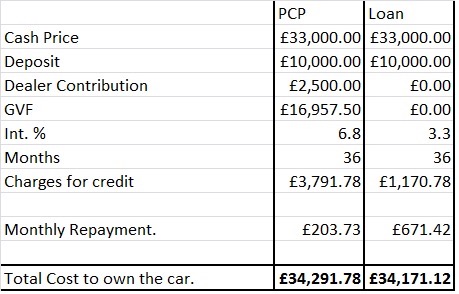

Perhaps it'll be useful to add some real numbers to this discussion...

This is an example using real numbers from a quote I received from an Audi main dealer, and using a loan from sainsbury's bank.

The pcp is based on a price that incorporates a £2500 deposit from Audi. This at the time was the standard for a 3 door S3. The contribution was not offered if Audi finance wasn't used;

This is an example using real numbers from a quote I received from an Audi main dealer, and using a loan from sainsbury's bank.

The pcp is based on a price that incorporates a £2500 deposit from Audi. This at the time was the standard for a 3 door S3. The contribution was not offered if Audi finance wasn't used;

Perhaps it'll be useful to add some real numbers to this discussion...

This is an example using real numbers from a quote I received from an Audi main dealer, and using a loan from sainsbury's bank.

The pcp is based on a price that incorporates a £2500 deposit from Audi. This at the time was the standard for a 3 door S3. The contribution was not offered if Audi finance wasn't used;

View attachment 84851

Not as large of a difference as I thought. Although, as I mentioned earlier, its very easy to get the dealer contribution on a cash purchase. For example, taking out a finance deal and then settling it within 14days. So it's about £2,600 cheaper....not a small amount of cash I guess, but not massive in the context of a £33k car...

Not as large of a difference as I thought. Although, as I mentioned earlier, its very easy to get the dealer contribution on a cash purchase. For example, taking out a finance deal and then settling it within 14days. So it's about £2,600 cheaper....not a small amount of cash I guess, but not massive in the context of a £33k car...

I am amazed VWFS still pay commission even if the finance is repaid with 14 days. I guess as long as the brand makes a sale, who cares at the end of the day?

Mercedes Benz pay their dealer bonuses in quarterly stages to discourage end of quarter sales to themselves and what you have described.

To make any meaningful sense of this, what you need now, is

Settlement figure from VWFS after 1 year

Value of car after 1 year

plus

Settlement figure from VWFS after 1 year

Value of car after 1 year

plus

Last edited:

I am amazed VWFS still pay commission even if the finance is repaid with 14 days. I guess as long as the brand makes a sale, who cares at the end of the day?

Mercedes Benz pay their dealer bonuses in quarterly stages to discourage end of quarter sales to themselves and what you have described.

Its possible different dealerships operate different in terms of the commission.

I still cant believe they are able to offer different prices on a product based on the method you pay for it. I know of a BMW dealership (not sure if this is dealer wide) that offer the same level of good discount regardless of how you choose to pay for it...

Therotecically, it's possible to do just that. I bought a Honda Jazz for my Mother-in-law using exactly that ruse. She was a full on cash buyer, using her savings to buy herself a new car, but to get the big discount, the freebies, the perks (and the salesman his commission from the finance co.) we got it on financed and settled it after a week.

If you want to play that game without the capital though, it gets trickier.

First you have to get a loan from from the finance company, then you need to get another loan for the same amount from a bank. If you've got a low amount on non-mortgage loans, and a VERY good credit rating, then there's no problem. However, if you have the credit rating of the average UK punter, you may find the second loan is either refused outright, or only offered at an interest rate that makes Audi's look reasonable. Taking two big loans in quick succession like that would be a red flag to most lenders, who may not appreciate the subtle nuances of your financial maneuverings, and instead think that you may represent a bit of a risk.

If you want to play that game without the capital though, it gets trickier.

First you have to get a loan from from the finance company, then you need to get another loan for the same amount from a bank. If you've got a low amount on non-mortgage loans, and a VERY good credit rating, then there's no problem. However, if you have the credit rating of the average UK punter, you may find the second loan is either refused outright, or only offered at an interest rate that makes Audi's look reasonable. Taking two big loans in quick succession like that would be a red flag to most lenders, who may not appreciate the subtle nuances of your financial maneuverings, and instead think that you may represent a bit of a risk.

Perhaps it'll be useful to add some real numbers to this discussion...

This is an example using real numbers from a quote I received from an Audi main dealer, and using a loan from sainsbury's bank.

The pcp is based on a price that incorporates a £2500 deposit from Audi. This at the time was the standard for a 3 door S3. The contribution was not offered if Audi finance wasn't used;

View attachment 84851

Interesting.

So basically £100pm in interest to VWFS, assuming you wrangle the £2.5k dealer contribution.

Strip that out, add in flexibility (no contract), no messing about with mileage charges/scratches/clauses and it's a one horse race.......IF you can afford the higher monthly payments.

Therotecically, it's possible to do just that. I bought a Honda Jazz for my Mother-in-law using exactly that ruse. She was a full on cash buyer, using her savings to buy herself a new car, but to get the big discount, the freebies, the perks (and the salesman his commission from the finance co.) we got it on financed and settled it after a week.

If you want to play that game without the capital though, it gets trickier.

First you have to get a loan from from the finance company, then you need to get another loan for the same amount from a bank. If you've got a low amount on non-mortgage loans, and a VERY good credit rating, then there's no problem. However, if you have the credit rating of the average UK punter, you may find the second loan is either refused outright, or only offered at an interest rate that makes Audi's look reasonable. Taking two big loans in quick succession like that would be a red flag to most lenders, who may not appreciate the subtle nuances of your financial maneuverings, and instead think that you may represent a bit of a risk.

Very true! Good point...not sure I would even try to take out two loans in such succession for fear of how it affects my rating...!!

Interesting.

So basically £100pm in interest to VWFS, assuming you wrangle the £2.5k dealer contribution.

Strip that out, add in flexibility (no contract), no messing about with mileage charges/scratches/clauses and it's a one horse race.......IF you can afford the higher monthly payments.

Again, not everything can be taken for granted. You don't need to do any wrangling for the dealer contribution. It was posted as an offer for several months on the Audi website.

Mileage charges etc. are only an issue if you a) go over your allotted miles, and b) hand the car back to the finance company. Trade it in or sell it privately and you don't need to worry about them. The above costs are based upon the fact that you've paid the final balloon payment, so mileage charges definitely aren't an issue there.

Where you see flexibility in having no contract, others will see flexibility in only having to fork out 1/3rd of the monthly payment every month.

The point is there is no perfect way to buy a car, because a car is money pit. It costs you a ****** fortune whichever way you buy it because it's an asset that depreciates in value faster than any financial instrument can keep up with.

My A3 is on a straight forward business lease on a 3+45 profile. I am going to try to switch over to a personal lease for various reasons but, from what I have read on this thread, a lease is the hassle free option. Whilst I will never own the car, I will never be in negative equity and I can drive around in a car that I could not afford to buy outright.

Have any of you considered a lease rather than a PCP?

Have any of you considered a lease rather than a PCP?

My A3 is on a straight forward business lease on a 3+45 profile. I am going to try to switch over to a personal lease for various reasons but, from what I have read on this thread, a lease is the hassle free option. Whilst I will never own the car, I will never be in negative equity and I can drive around in a car that I could not afford to buy outright.

Have any of you considered a lease rather than a PCP?

I did, but lease deals on a V6 petrol seem far and few between...

Excess mileage charges only apply if you hand the car back (which is unlikely), and the ability to add options and adjust the monthly figure with the amount upfront meant a PCP suited me better.

Certainly wouldn't discount it though if I could find a way to make it work for me.

The link in post #1 contains a google docs spreadsheet, which will show you exactly how much your PCP is costing you:

http://forums.moneysavingexpert.com/showthread.php?t=5129505

(you may have to make a copy of it to your own space, to get it to work)

http://forums.moneysavingexpert.com/showthread.php?t=5129505

(you may have to make a copy of it to your own space, to get it to work)

Leased for the last 4 years, My new S3 DSG NAV,comes 14th April 6over 23 £260 a month with full maintenance, tax, Cant go wrong with that,

Thats not bad at all...

What sort of mileage does that allow?

10k Was on Gateway2lease for about two days then went as all orders were taken, did have a golf r 5dr DSG on order at £273 with fleet prices but had no sat nav cancelled for Audi nav and leather seats instead. If you look about you can get really cheap cars if your a bit flexible

Mine certainly was, over a grand underwater after 18 months, even with a reasonable deposit. If it hadn't been for gap insurance I'd have been in a sticky situation.There's a lot of man maths going on here, so far, nobody has actually mentioned that the settlement figure, given to you by VWFS, is very often considerably higher than the valuation of the car, especially in the first 2 years.

It is no wonder people are under water for the first 18 months of an agreement.

You are charged interest on both the GFV and the amount borrowed. It takes time for the capital element of your repayment to start making a dent in the amount borrowed balance reducing the interest charged.

You are charged interest on both the GFV and the amount borrowed. It takes time for the capital element of your repayment to start making a dent in the amount borrowed balance reducing the interest charged.

Mine certainly was, over a grand underwater after 18 months, even with a reasonable deposit. If it hadn't been for gap insurance I'd have been in a sticky situation.

It is no wonder people are under water for the first 18 months of an agreement.

You are charged interest on both the GFV and the amount borrowed. It takes time for the capital element of your repayment to start making a dent in the amount borrowed balance reducing the interest charged.

^ This !!!

You are paying interest not only on the amount financed, but also the GMFV figure !

So when settlement time comes at 12 or 18 or 24 months (in a 36 or 48 month PCP), you will be underwater - hence the need to look at your settlement figure versus the actual value of the car at that time.

And if you've loaded the car with options - the bigger the variance will be.

PCP is a great money maker for finance companies.

I put £2k deposit in to my A1 before my S3 and come trade in for that car, I only had £1k of that left in equity.

I then put an extra £1.7k on top of my £1k equity from the A1 to get in to my S3.

Currently I have about £1k of equity in my S3. On this basis Audi have been a good brand to be in for me as I've only "lost" £2.7k in deposit cash in over the last 4 years. That's good compared to a lot of other brands.

However, if I want an RS3, I need to find another £4k and then stretch my payments over 4 years (I usually do 3 years). More and more cash everytime and this is what has slammed the brakes on for me with the RS3.

Dealers call this the "PCP ladder" I believe. You always want a better model so you put more and more in every time you change. It's clever and very profitable

I then put an extra £1.7k on top of my £1k equity from the A1 to get in to my S3.

Currently I have about £1k of equity in my S3. On this basis Audi have been a good brand to be in for me as I've only "lost" £2.7k in deposit cash in over the last 4 years. That's good compared to a lot of other brands.

However, if I want an RS3, I need to find another £4k and then stretch my payments over 4 years (I usually do 3 years). More and more cash everytime and this is what has slammed the brakes on for me with the RS3.

Dealers call this the "PCP ladder" I believe. You always want a better model so you put more and more in every time you change. It's clever and very profitable

Last edited:

And the so-called "equity" is you over-paying anyway, in a form of an enforced savings plan

I ditched the ladder and got my new car without PCP. Nice to not have to worry.

You did have the assistance of GAP

So ultimately PCP is ok, but the longer you keep the car the better.

And the A3/S3/RS3 do hold their values very well comparatively.

But if you constatly chop in early for a better model, without planning/thinking ahead, you will end up effectively just renting a car and owning nothing.

And as I said in another thread, that is fine while your income is good. But when times are hard.......?

I also used this analogy before:

Loan/HP = Repayment mortgage (high repayments / owner at end of term)

PCP = Interest only mortgage (lower repayments/may have some equity at end depending on conditions)

Lease = Renting (cheapest / will not have anything at end of term)

And the A3/S3/RS3 do hold their values very well comparatively.

But if you constatly chop in early for a better model, without planning/thinking ahead, you will end up effectively just renting a car and owning nothing.

And as I said in another thread, that is fine while your income is good. But when times are hard.......?

I also used this analogy before:

Loan/HP = Repayment mortgage (high repayments / owner at end of term)

PCP = Interest only mortgage (lower repayments/may have some equity at end depending on conditions)

Lease = Renting (cheapest / will not have anything at end of term)

Firstname_lastname

in ur base killin ur doodz

Leased for the last 4 years, My new S3 DSG NAV,comes 14th April 6over 23 £260 a month with full maintenance, tax, Cant go wrong with that,

Who many miles P/A? i am just about to start paying £380 fully maintained for a manual S3 NAV with tyres/maintenance with 15K miles P/A on a business lease.

10k This website is a good one for leasing http://www.contracthireandleasing.com/personal/car-contract-hire-and-leasing/Who many miles P/A? i am just about to start paying £380 fully maintained for a manual S3 NAV with tyres/maintenance with 15K miles P/A on a business lease.

Firstname_lastname

in ur base killin ur doodz

10k This website is a good one for leasing http://www.contracthireandleasing.com/personal/car-contract-hire-and-leasing/

That's a cracking deal, £280 is how much we are currently paying for my GTD.

Derail over...

Manufacturers aren't doing it for fun and don't lose money on it that's for sure (including keeping a nice stock of lightly used premium marques) and as per Pulp84s comment they know people will want the next big thing.

It is simply a mechanism of selling and they were designed to be used to sell more expensive cars to people who couldn't afford to buy (generally) hence the balloon.....if the punter is happy paying interest on a large loan then so be it but I wouldn't be. Normally the sooner you change the more you are charged, people need to consider when they use terms like equity as ultimately you have still (over)paid for it in advance, and don't chop and change every year. If you buy the car outright at the start then hey the car market is your oyster.

The UK is car obsessed hence the popularity of PCP, other Euro countries where there is less emphasis on the car badge/age are years behind with PCP. When you spend cold hard cash you are a lot more critical and the new car needs to justify itself better hence why for me (living in a cash world) moving from an S3 to a RSn or whatever is not worth the cash............plenty of people on here bought M/R/GTI/AMG/RSn as it only added £xx per month which is cool providing they genuinely understand the business model behind it - the market needs people to spend their money providing the the market with nice lightly used immaculate 2nd hand motors.

It is simply a mechanism of selling and they were designed to be used to sell more expensive cars to people who couldn't afford to buy (generally) hence the balloon.....if the punter is happy paying interest on a large loan then so be it but I wouldn't be. Normally the sooner you change the more you are charged, people need to consider when they use terms like equity as ultimately you have still (over)paid for it in advance, and don't chop and change every year. If you buy the car outright at the start then hey the car market is your oyster.

The UK is car obsessed hence the popularity of PCP, other Euro countries where there is less emphasis on the car badge/age are years behind with PCP. When you spend cold hard cash you are a lot more critical and the new car needs to justify itself better hence why for me (living in a cash world) moving from an S3 to a RSn or whatever is not worth the cash............plenty of people on here bought M/R/GTI/AMG/RSn as it only added £xx per month which is cool providing they genuinely understand the business model behind it - the market needs people to spend their money providing the the market with nice lightly used immaculate 2nd hand motors.

The UK is car obsessed hence the popularity of PCP, other Euro countries where there is less emphasis on the car badge/age are years behind with PCP.

As a nation, we are addicted to consumer credit (debt). It's like a drug.

In UK 2015 (FLA figures)

Retail & Online credit grew by 2%

Credit Cards & Personal Loans grew by 4%

Car Finance grew by 15% !!!

as it only added £xx per month which is cool providing they genuinely understand the business model behind it

And this is where I've spoken to quite a few "less sharp", more mature sales people, who regale me with tales of having to sit down with Mrs. Trellis to explain why, after years of buying her cars on HP, after her first couple of PCP contracts, her monthly payments, suddenly, doesn't give her a car to "own" at the end of the term.......

It's is horses for courses, but you do need to go in with your eyes wide open. I'm neither advocating nor condoning PCP, it has its pro and cons, there is no such thing as a free lunch, at the end of the day when all said and done, the finance company will be making money.

Last edited:

Think it'sHave a look at the opening balance of the VWFS statement, compared with the balance to finance on the invoice

There's a lot of man maths going on here, so far, nobody has actually mentioned that the settlement figure, given to you by VWFS, is very often considerably higher than the valuation of the car, especially in the first 2 years.

My settlement figure is £27,800 Audi offered £24,000 that's after exactly 12 months ideally l would want £26k for my car happy to except £1800 negative equity,not nearly £4000 that's the deal breaker on my TTS even with £7000 to hand

Kugaman1

Registered User

- Joined

- Mar 27, 2015

- Messages

- 685

- Reaction score

- 607

- Points

- 93

£24k is frankly insulting.

Ive played this game for several years now, changing cars every 6 months to a year. Its financial suicide.

Ive suddenly woken up and decided to stop lining my dealers pockets.

Good luck Jassy......maybe you can get a better deal at Aberdeen Audi? They were certainly willing to play when I ordered the RS3 and also the wifes a1......

Ive played this game for several years now, changing cars every 6 months to a year. Its financial suicide.

Ive suddenly woken up and decided to stop lining my dealers pockets.

Good luck Jassy......maybe you can get a better deal at Aberdeen Audi? They were certainly willing to play when I ordered the RS3 and also the wifes a1......

£24k is frankly insulting.

Ive played this game for several years now, changing cars every 6 months to a year. Its financial suicide.

Ive suddenly woken up and decided to stop lining my dealers pockets.

Good luck Jassy......maybe you can get a better deal at Aberdeen Audi? They were certainly willing to play when I ordered the RS3 and also the wifes a1......

In contact with some other car dealer just now,just waiting on his price

- Status

- Not open for further replies.