Just want to make sure I got this right, dealer said at the end of the term I could give the car back and they’d pay me the cash difference in the value vs the gfv. Is that right? Say the car is worth £30k trade in and gfv is £23k, they’d give me £7k. Is that correct? So instead of using the £7k towards a new pcp, I could have the cash? Didn’t know you could do that?

Quick pcp question…

- Thread starter Jason1987

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Just want to make sure I got this right, dealer said at the end of the term I could give the car back and they’d pay me the cash difference in the value vs the gfv. Is that right? Say the car is worth £30k trade in and gfv is £23k, they’d give me £7k. Is that correct? So instead of using the £7k towards a new pcp, I could have the cash? Didn’t know you could do that?

Yes, or you could sell the car outside of the manufacturer network or privately as long as the finance (balloon) is settled the rest is yours. People often go down the P/X and new model route as “easy” but that is how they hook you in, and not a requirement at all

Oh I thought if you just hand the car back you lose everything? Why doesn’t everyone get the dealers to pay them back the difference then? Obv if car has equity. I thought you had to buy the car then sell it? If I can just give the car back to Audi at the end and they pay me the equity, that would be perfect but just checking it can be done? Seems to good to be true doing it that way?Yes, or you could sell the car outside of the manufacturer network or privately as long as the finance (balloon) is settled the rest is yours. People often go down the P/X and new model route as “easy” but that is how they hook you in, and not a requirement at all

Oh I thought if you just hand the car back you lose everything? Why doesn’t everyone get the dealers to pay them back the difference then? Obv if car has equity. I thought you had to buy the car then sell it? If I can just give the car back to Audi at the end and they pay me the equity, that would be perfect but just checking it can be done? Seems to good to be true doing it that way?

Useless they really want the car, unlikely to offer you the cash (assuming higher than balloon), but not impossible. I did sell my last BMW back to the dealer that supplied and they settled the finance and transferred the difference. But also plenty other places that buy such as WBAC and Motorway

Oh so not often they do this? Most people have to get a loan and buy car then sell after?Useless they really want the car, unlikely to offer you the cash (assuming higher than balloon), but not impossible. I did sell my last BMW back to the dealer that supplied and they settled the finance and transferred the difference. But also plenty other places that buy such as WBAC and Motorway

Also, what’s the benefits of doing 3 years at 9.9% or 4 years at 9.8%. Does it make much difference? I can’t decide which term to do, I’d obviously prefer the lower monthly’s but if I’m wasting money doing 4 years I’d rather do 3 and pay more a month

Did they give you the basic amounts, that is the monthly payment and the residuals in both cases? You need these to make a proper comparison, but as a general rule you will always pay more in total interest if you choose the longer period.Also, what’s the benefits of doing 3 years at 9.9% or 4 years at 9.8%. Does it make much difference? I can’t decide which term to do, I’d obviously prefer the lower monthly’s but if I’m wasting money doing 4 years I’d rather do 3 and pay more a month

I’m just using the pcp calculator on Audi website. Gfv is £25k at 3 years and £23k at 4 yearsDid they give you the basic amounts, that is the monthly payment and the residuals in both cases? You need these to make a proper comparison, but as a general rule you will always pay more in total interest if you choose the longer period.

Also I can’t get my head round the deposit. So if I put no deposit, it’s £29732 over the 4 years but if I put £3k deposit, its £26295 over 4 years so why would I put £3k in to save £437? As that £3k disappears as gfv is the same. What am I missing here? Surely you’d just use no deposit and just pay £437 interest over the 4 years? Why waste £3k?

Last edited:

By putting in a bigger deposit you’re going to reduce your monthly payments but the balloon usually remains the same. The benefit of a bigger deposit is that you’re not paying interest on that amount (in your case you’re saving 9.9% on £3k)Also I can’t get my head round the deposit. So if I put no deposit, it’s £29732 over the 4 years but if I put £3k deposit, its £26295 over 4 years so why would I put £3k in to save £437? As that £3k disappears as gfv is the same. What am I missing here? Surely you’d just use no deposit and just pay £437 interest over the 4 years? Why waste £3k?

But as I’m only saving £400 in total. If I don’t put £3k deposit in I only lose £400 interest instead of losing £3k. As in it would be the gfv of £23k plus 47x whatever the payment is per month which would only be £400 more with no deposit?By putting in a bigger deposit you’re going to reduce your monthly payments but the balloon usually remains the same. The benefit of a bigger deposit is that you’re not paying interest on that amount (in your case you’re saving 9.9% on £3k)

You will be paying that £3k one way or the other. You will either pay it upfront as deposit and save about £400 interest, or you will be paying one 47th x £3400 (£72.34) for every month of the term, in addition to your monthlies you would be paying if you had put that £3k in upfront.But as I’m only saving £400 in total. If I don’t put £3k deposit in I only lose £400 interest instead of losing £3k. As in it would be the gfv of £23k plus 47x whatever the payment is per month which would only be £400 more with no deposit?

Is your total less than the total amount payable or more? Maybe you've got a few options you haven't accounted for (higher total amount payable), or you got a bit of dealership discount you haven't accounted for (lower total amount payable)?If I add my deposit, 35x the monthly payment, the £3k contribution and baloon payment, it still doesn’t add up to the total amount payable figure. Where is the extra from?

Well when I add the total amount borrowed it adds up as I’m paying interest on the baloon too but when I add up what I’m actually paying per month etc it doesn’t match that figure. I think mine came in lessIs your total less than the total amount payable or more? Maybe you've got a few options you haven't accounted for (higher total amount payable), or you got a bit of dealership discount you haven't accounted for (lower total amount payable)?

Yes, you are always paying interest on the balloon payment, you don't get an interest free loan on the future value of the car, you are paying interest on all capital owed.Well when I add the total amount borrowed it adds up as I’m paying interest on the baloon too but when I add up what I’m actually paying per month etc it doesn’t match that figure. I think mine came in less

I don’t see where that interest is being charged though? I assumed it would be built in to the baloon payment as my monthly payments, deposit and baloon payment don’t match the total amount payable so when do I pay that extra?Yes, you are always paying interest on the balloon payment, you don't get an interest free loan on the future value of the car, you are paying interest on all capital owed.

You are borrowing the whole car from them, so you pay interest on the whole amount, minus the capital amounts paid from your monthlies as the agreement carries on, whether you buy it at the end or not.I don’t see where that interest is being charged though? I assumed it would be built in to the baloon payment as my monthly payments, deposit and baloon payment don’t match the total amount payable so when do I pay that extra?

You are borrowing the whole car from them, so you pay interest on the whole amount, minus the capital amounts paid from your monthlies as the agreement carries on, whether you buy it at the end or not.

The agreement will show the cost of the car after any deposits or contributions are taken off and then the interest is added - In the first 12 months your capital payments don't reduce the balance much but as the agreement goes on you will see that your monthly payments start to reduce the balance by that amount which is why if you then request a settlement say after 2 years of a 3 year agreement you are refunded some of the interest back because you pretty much paid it in your first yearI don’t see where that interest is being charged though? I assumed it would be built in to the baloon payment as my monthly payments, deposit and baloon payment don’t match the total amount payable so when do I pay that extra?

Not quite right on the refund of interest.The agreement will show the cost of the car after any deposits or contributions are taken off and then the interest is added - In the first 12 months your capital payments don't reduce the balance much but as the agreement goes on you will see that your monthly payments start to reduce the balance by that amount which is why if you then request a settlement say after 2 years of a 3 year agreement you are refunded some of the interest back because you pretty much paid it in your first year

If you take out a 3 year PCP, monthlies are calculated on how much money has been put down (your deposit, deposit contribution, dealership discount). They calculate the interest to be paid on the remainder over the term and divide it equally into monthly increments, along with the payments against capital, to offset depreciation.

You then decide to get out early, so you'll need some of that interest back (minus 58 days penalty interest for early redemption). This is so you don't end up paying 3 years interest on a loan that might only last 2 years.

I don’t see why the total amount payable figure isn’t my 47x monthly payments, deposit and then baloon payment added together? As that’s all I’d be paying unless I’m charged another £2k from somewhere to match the total payable figure on the calculator, unless I’m working it out wrong

Yes, you are right it's just the interest you pay reduces each month as the balance comes down, so that more of your capital is put against the loan - Like you say you get refunded some interest back if settling earlyNot quite right on the refund of interest.

If you take out a 3 year PCP, monthlies are calculated on how much money has been put down (your deposit, deposit contribution, dealership discount). They calculate the interest to be paid on the remainder over the term and divide it equally into monthly increments, along with the payments against capital, to offset depreciation.

You then decide to get out early, so you'll need some of that interest back (minus 58 days penalty interest for early redemption). This is so you don't end up paying 3 years interest on a loan that might only last 2 years.

This is actually a very round error I noticed myself while trying out the Audi UK website calculator, but I thought I might be missing something, since I am based in continental Europe and not overly familiar with all the terms. Maybe someone else could shed more light here.I don’t see why the total amount payable figure isn’t my 47x monthly payments, deposit and then baloon payment added together? As that’s all I’d be paying unless I’m charged another £2k from somewhere to match the total payable figure on the calculator, unless I’m working it out wrong

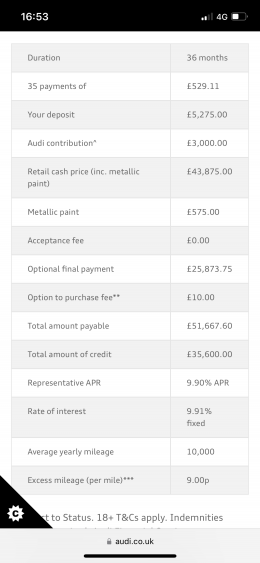

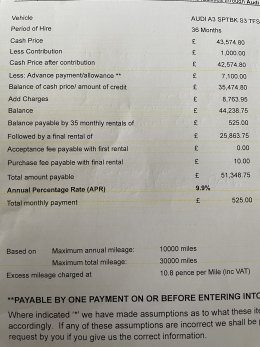

So I’ve ordered my s3.. my total amount payable is £51,348 but my 35x monthly payments only add up to £18k. I read that you can do an early termination once you have paid half, but how much is it im liable for? I can’t quite work it out. I’m also putting £5k down. My total amount of credit is £35k

I couldn't do the sums without seeing all numbers - there'll be deposit contributions from the finance company, your deposit, maybe some dealership discount, some other numbers in the mix that've maybe been forgotten etc. So you're only paying about £500pm after your £5k deposit? If the GFV is more than half the amount of the car's RRP, you'll never reach that 50% threshold to hand it back. Its 50% of the total amount payable for the car (and interest paid to the point of handback).So I’ve ordered my s3.. my total amount payable is £51,348 but my 35x monthly payments only add up to £18k. I read that you can do an early termination once you have paid half, but how much is it im liable for? I can’t quite work it out. I’m also putting £5k down. My total amount of credit is £35k

Basically I want to know how much I owe. Say 3 months of having the car I want to buy it, would it be my total amount of credit which is £35.4k minus some interest I’ve paid on the 3 months payments? See my figures below:I couldn't do the sums without seeing all numbers - there'll be deposit contributions from the finance company, your deposit, maybe some dealership discount, some other numbers in the mix that've maybe been forgotten etc. So you're only paying about £500pm after your £5k deposit? If the GFV is more than half the amount of the car's RRP, you'll never reach that 50% threshold to hand it back. Its 50% of the total amount payable for the car (and interest paid to the point of handback).

Attachments

From looking at that, having that £1000 allowance from the dealer (they pay £1000 of the £3000 deposit contribution, Audi finance pay the other £2000), having £7100 paid elsewhere "advance payments" (that would seem to be your £5k deposit, £2k from the Finance deposit contribution, and the £100 - perhaps from dealer discount?) - what's left on the car is £35474.80, plus interest for however long you have it, plus 58 days penalty interest. You'll be reducing that balance with every month's payments. In the early days, about £220pm of your £525pm will be reducing your car's balance, the rest is interest.Basically I want to know how much I owe. Say 3 months of having the car I want to buy it, would it be my total amount of credit which is £35.4k minus some interest I’ve paid on the 3 months payments? See my figures below:

It looks to me that you have little to no dealership contribution (except maybe that odd £100 from the £7100), unless you already had it knocked off the RRP. Are you going with your local dealer, or Drive the Deal?

It’s quite confusing but I basically got the payment down compared to the pcp calculator and also got extras for less per month than the Audi website pcp calc, it would have been about £550 with options and I got it for £525 a month. Audi website says £529 just for the car with paint. So say in 3 months time I want to get a loan to buy the whole car, I’d need to pay £35474 minus Interest I’ve paid? So I’d never owe more than the £35474? Just trying to get my head round it all. As say I lost my job and had to give the car back, I was thinking as I’ve put £5k down, and Audi would sell the car for about £42k as it would be say 3 months old, how much would I have to put in to walk away from the car in worst case scenario. Surely in 6 months time with my payments plus the deposit, would be enough to just hand car back?From looking at that, having that £1000 allowance from the dealer (they pay £1000 of the £3000 deposit contribution, Audi finance pay the other £2000), having £7100 paid elsewhere "advance payments" (that would seem to be your £5k deposit, £2k from the Finance deposit contribution, and the £100 - perhaps from dealer discount?) - what's left on the car is £35474.80, plus interest for however long you have it, plus 58 days penalty interest. You'll be reducing that balance with every month's payments. In the early days, about £220pm of your £525pm will be reducing your car's balance, the rest is interest.

It looks to me that you have little to no dealership contribution (except maybe that odd £100 from the £7100), unless you already had it knocked off the RRP. Are you going with your local dealer, or Drive the Deal?

Yes, you'll never owe more than £35474 once it's a few months old (if you changed your mind after a month, the 58 days early repayment penalty interest would be more than the capital part of your first 2 monthly payments, maybe 3.It’s quite confusing but I basically got the payment down compared to the pcp calculator and also got extras for less per month than the Audi website pcp calc, it would have been about £550 with options and I got it for £525 a month. Audi website says £529 just for the car with paint. So say in 3 months time I want to get a loan to buy the whole car, I’d need to pay £35474 minus Interest I’ve paid? So I’d never owe more than the £35474? Just trying to get my head round it all. As say I lost my job and had to give the car back, I was thinking as I’ve put £5k down, and Audi would sell the car for about £42k as it would be say 3 months old, how much would I have to put in to walk away from the car in worst case scenario. Surely in 6 months time with my payments plus the deposit, would be enough to just hand car back?

If you lost your job down the line and needed to hand back,I'd check with Motorway.co.uk or a similar selling agent first as the car could be worth more than you owe at any given time e.g. at 2 years old, you owe £28k on the car and lose your job. Motorway.co.uk say your car is worth £32k to them. The buyer they arrange would pay off the £28k to finance and give you £4k. Better than just handing back.

Ah thanks that’s what I needed to know. So basically my 35x £525 payments comes to £18375, where as I think the capital is only £9k so is that £9375 extra the Interest for the whole amount of credit of £35474?Yes, you'll never owe more than £35474 once it's a few months old (if you changed your mind after a month, the 58 days early repayment penalty interest would be more than the capital part of your first 2 monthly payments, maybe 3.

If you lost your job down the line and needed to hand back,I'd check with Motorway.co.uk or a similar selling agent first as the car could be worth more than you owe at any given time e.g. at 2 years old, you owe £28k on the car and lose your job. Motorway.co.uk say your car is worth £32k to them. The buyer they arrange would pay off the £28k to finance and give you £4k. Better than just handing back.

Yeah my gfv is £25k so more than double the rrp of the car. is that good or bad that I’m over the 50% already?I couldn't do the sums without seeing all numbers - there'll be deposit contributions from the finance company, your deposit, maybe some dealership discount, some other numbers in the mix that've maybe been forgotten etc. So you're only paying about £500pm after your £5k deposit? If the GFV is more than half the amount of the car's RRP, you'll never reach that 50% threshold to hand it back. Its 50% of the total amount payable for the car (and interest paid to the point of handback).

Yes you're right. That £9375 interest could be drastically reduced if you settled early and bought the car outright.Ah thanks that’s what I needed to know. So basically my 35x £525 payments comes to £18375, where as I think the capital is only £9k so is that £9375 extra the Interest for the whole amount of credit of £35474?

So £305 a month is interest out of £525 wow what a joke it is buying a car theses days with 9.9% APR . I bought my S3 brand new in march 2019 and the APR was 4.8% big difference to todays APR's . I paid my car off nearly 2 years back but I'am really apprehensive about getting into another PCP deal at these crazy rates .From looking at that, having that £1000 allowance from the dealer (they pay £1000 of the £3000 deposit contribution, Audi finance pay the other £2000), having £7100 paid elsewhere "advance payments" (that would seem to be your £5k deposit, £2k from the Finance deposit contribution, and the £100 - perhaps from dealer discount?) - what's left on the car is £35474.80, plus interest for however long you have it, plus 58 days penalty interest. You'll be reducing that balance with every month's payments. In the early days, about £220pm of your £525pm will be reducing your car's balance, the rest is interest.

It looks to me that you have little to no dealership contribution (except maybe that odd £100 from the £7100), unless you already had it knocked off the RRP. Are you going with your local dealer, or Drive the Deal?

Initially, yes, it'll drop to about £230pm at the end of term, average interest over term is £267pm interest. If that silly rate puts enough people off, they'll have drop it. You're probably no worse off on the monthlies because the GFV is higher - you're paying less capital off the car, but more interest - if you're a perpetual PCPer. If you're looking to buy at the end, you'll be a lot worse off. If you've got a great credit rating but haven't got the savings to buy outright, I'd look to take a bank loan out to cover the cost of the whole car about 3 months before the car's due, take the Audi finance, grab the deposit contribution and withdraw within 14 days, and pay off the car with the bank loan.So £305 a month is interest out of £525 wow what a joke it is buying a car theses days with 9.9% APR . I bought my S3 brand new in march 2019 and the APR was 4.8% big difference to todays APR's . I paid my car off nearly 2 years back but I'am really apprehensive about getting into another PCP deal at these crazy rates .

If you buy the car outright from the start, a higher GFV means you'll lose less in depreciation while you own it. If you are PCPing, Audi finance are robbing Peter to pay Paul (less capital paid to counteract the higher interest rate. I bet the overall monthlies aren't appreciably higher in total than last years 4.8% APR deals. It also means if you buy it at the end, you'll pay more overall. Your overall price to do that is about £51k,last year it would've been more like £47k.Why do people say a higher gfv is better? Surely it means you have less equity as the value is higher come trade in

I'am just glad I own mine out riteInitially, yes, it'll drop to about £230pm at the end of term, average interest over term is £267pm interest. If that silly rate puts enough people off, they'll have drop it. You're probably no worse off on the monthlies because the GFV is higher - you're paying less capital off the car, but more interest - if you're a perpetual PCPer. If you're looking to buy at the end, you'll be a lot worse off. If you've got a great credit rating but haven't got the savings to buy outright, I'd look to take a bank loan out to cover the cost of the whole car about 3 months before the car's due, take the Audi finance, grab the deposit contribution and withdraw within 14 days, and pay off the car with the bank loan.

My car was £40688 but I haggled over a few days and got the car for £35k I put my car in has part ex and a few grand think my deposit was around £18k monthly payments of around £220 .If you buy the car outright from the start, a higher GFV means you'll lose less in depreciation while you own it. If you are PCPing, Audi finance are robbing Peter to pay Paul (less capital paid to counteract the higher interest rate. I bet the overall monthlies aren't appreciably higher in total than last years 4.8% APR deals. It also means if you buy it at the end, you'll pay more overall. Your overall price to do that is about £51k,last year it would've been more like £47k.

I over paid where I could over the first 2 and half years of the deal which got me to the balloon payment early which was £8400 which i paid off and still own it to this day .

Is it with over paying on a pcp?My car was £40688 but I haggled over a few days and got the car for £35k I put my car in has part ex and a few grand think my deposit was around £18k monthly payments of around £220 .

I over paid where I could over the first 2 and half years of the deal which got me to the balloon payment early which was £8400 which i paid off and still own it to this day .