Run out model .... .. Bollards not yet it ain't, your post is all about fiddling the numbers mate ..... Deposit contribution and discount combined or separate are one in the same thing, the new car is about 14 months away at least, got all these guff posts before when the facelift was introduced...... But *** they weren't a year or so before the car was revealed

Precisely!

The question is whether levels of discounts will remain the same, or just be reduced in line with increase contributions? The total discount you get from brokers always includes the deposit contribution. Around 14% has been possible, but from doing some quick check online, it still seems to be around 14%...?

The fact that the discount is made up of a higher proportion of deposit contribution can be good though, as it helps with VT. Pretty sure deposit contributions count towards 'paid contributions', whereas discounts just lower the cost of the total amount payable. If I've understood it right, the net effect is that extra deposit contributions have a greater effect than discounted price when it comes to reaching the VT point.

I called my dealer this morning and it actually works out more expensive - it just looks good.

Yea, if overall level of discount is the same, then a change of 1.5% will add around £1,000 extra on a typically 48month deal, depending on the price, deposit and length of term of course. I imagine the GFV has been altered too though.

Bagging the discount then refinancing the PCP with a car loan may save some interest due on the monthly payments.

I think you are underestimating just how much interest you get charged on a PCP loan vs. a standard loan...it's not 'some' and there is no 'may' about it, It will absolutely save you money, and its typically thousands of pounds.

To give you an idea, I've looked at the finance details of a A3 SB 1.5TFSI S-Tronic Black Edition with no options, using the level of discount from Coast2Coast.

£5k down on a 36m/10k mile PCP deal, it will cost you £3,632 in interest charges.

£5k and a personal loan of the same amount over the same 36m period at 3% APR will cost you £974 in interest charges.

That's a saving of £2,658.

Even a personal loan at the same APR rate of 6.4% will be £2,080, still £1,552 cheaper.

(Comparing APR rates between different types of loans is pointless and tells you nothing about the amount of interest you are being charged. For perspective, for a personal loan to cost the same amount in interest as the PCP loan above, it would have to be charged at an APR of 11.2%.....)

However, with a PCP you can give the car back when 50% of the finance value is repayed. This gives you some protection from used car values dropping like a stone and putting your car into negative equity. VWFS have to take the car back and suck up the negative equity as per the PCP agreement

In the context of VT, you can VT when 50% of the total amount payable is paid. On the deal I've looked at, the total amount payable is around £32,470. So that means paying £16,235 before you can VT. With £5k down, the £2,780 deposit contribution, and monthlies of £276, this will occur around the 31month mark. By that stage, you would have paid ~£16,300. As you rightly say, you can now walk away.

Now the anticipated value at this point is around £15,500 using the GFV on the Audi calculator at 30months. So as above the car would have to be worth <£13,000 (not quite the full £2,658 saving, since you have saved on 5months interest in this scenario) before you start seeing any financial advantage from going PCP over personal loan route.

How likely is that...? When you consider that £13,000 is what it is currently predicted to be worth at 48months/40k miles, I would suggest quite slim...

Put it this way...if someone offered you a personal loan at 3% for the amount, and then said for £2,500 they would sell you a form of insurance that guarantees the value of the car of £15,500 at 32months and 20,000 miles, would you buy it...?

As ever, I think the protection in the form of a GFV and VT using a PCP are grossly over-estimated since they ignore the inordinately high interest costs that come with having one in the first place.

The 50% rule doesn't apply to car loans meaning you have no choice but to either pay the full term of the loan or find the short fall to clear the negative equity if you decide to sell early.

There will be no negative equity on a personal loan.

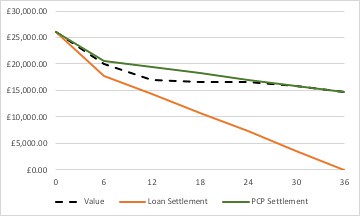

I'm almost certain that the amount of finance you owe on the loan will be lower than the value of the asset from about month 6 onwards, if not before (I cant get predicted values of the car from months 1-18).

Case in point, using the above example if you put £5k down and are paying £612 per month, by 12 months your settlement will be just £14,311. I think it's safe to say a 1yr old A3 will very obviously be worth more than that, considering that's less than the predicted value at the end of 36months/30k miles!